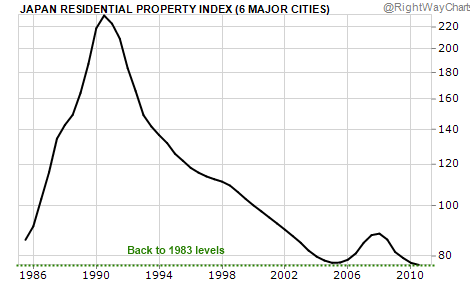

Looking into the Japanese real estate mirror: Residential home prices in Japan back to levels last seen 30 years ago in spite of near zero percent mortgage rates. http://

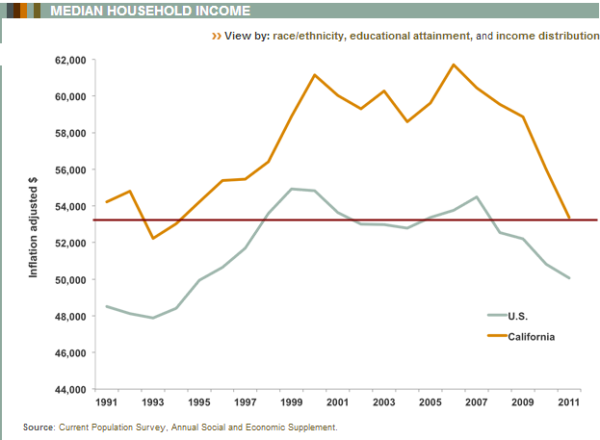

When the Japanese housing bubble burst in 1990 the economy was left in disarray. Hard to believe that this happened 23 years ago but real estate prices in Japan are now at levels last seen in 1983. In other words, thirty years of virtually no real growth in real estate values. In a system conditioned by inflation this is a perfect example of asset deflation. Many simply assume that real estate appreciation is going to happen one way or another but we are now following a low rate policy similar to what the Bank of Japan did with quantitative easing. 2012 is not a good example to set a baseline for a trend because interest rates were pushed down heavily by the Fed and inventory continues to be held off creating a low level of supply on the market. Yet when we look at what Americans can afford on a monthly basis, it is virtually locked because household incomes have been stagnant for well over a decade. The Japanese asset boom and bust provides many parallels to what we should expect in the US. Many point to 2012 as some sort of divergence but this is more a reflection of aggressive quantitative easing and low inventory more than a sustainable boom because of solid economic and wage growth.

Japan Prices back to 1983 levels

Residential property values in Japan are now back to levels last seen in 1983:

Japan is an important case example because in 1990, Japan had a GDP of $3.1 trillion and the US was at $5.7 trillion. Japan for many years was the second largest economy. But today Japan’s GDP is what it was in 1995. The Bank of Japan bailed out the banking system with bucket loads of troubled assets and forced rates to incredibly low levels. You can get mortgages in Japan in the 2 percent range but once again, refer to the first chart.

Some people take the next step and talk about zero percent mortgage rates. Why speculate when we can look at Japan for an example:

“(BBC) Yoshifumi Tachibana, 32, might be one. He recently bought an apartment worth 60 million yen (£478,782; $766,430) in central Tokyo.“I was told I’d get the best mortgage rate if paid about 20% up front, so I did,” he says.“Low interest rates were definitely one of the reasons for me to decide to buy my first home. I borrowed 47 million yen and I am on a 35-year repayment plan with an interest rate of 0.075%.”But despite such attractive rates, real estate agent Hidetaka Miyazaki says he has not seen an increase in the number of buyers and investors in the last 20 years, especially not in sub-urban areas.”

Essentially what is happening is market manipulation of rates to keep home prices inflated for banks. In Japan, the support to banks has been nearly unlimited since the real estate bubble burst in 1990. The Fed is following a very similar road allowing banks to selectively hold off properties from the market whilepushing rates lower to keep prices higher. Since there are zero conditions on bailouts or funding, banks can do what they see fit even in the aftermath of the greatest housing bubble in US history.

Sales from the bottom

Here is an interesting take from economist Dean Baker:

“Both the NYT and USA Today have convinced themselves that house sales are well below their trend level, with the latter telling us that a 5.5 million annual sales rate of existing homes considered healthy. In fact, we are pretty much back to trend levels of sales. In the mid-90s before the bubble began to distort the market, sales averaged about 3.5 million a year. A simple adjustment for the 15 percent population growth over this period would imply an annual sales rate of 4 million existing homes. That is somewhat below the current 4.5 million sales rate.”

Today existing home sales are 5.04 million in November of 2012. There is massive speculation and much of this is coming from investors, flippers, and foreign money. Low rates create massive market distortions. At least in this sense we are different from Japan but this is going on right now. Will investors continue to be a big part of the market moving forward? Not long-term. Yields are already collapsing in many places like Arizona and Las Vegas and investors will pull back.

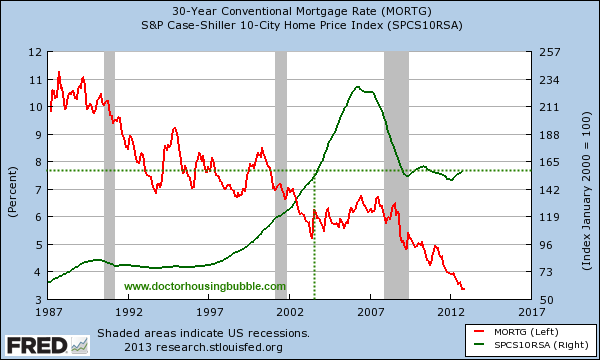

US and mortgage rates

US home values are now back to prices last seen in 2003. A lost decade has already occurred:

Keep in mind that in 2003, mortgage rates were in the 6 percent range and now have fallen by over 50 percent thus increasing what Americans can take on to purchase a home. Home prices have not shot up in a similar fashion because households have not seen any real wage increases:

Someone nailed the prediction on lower mortgage rates here:

“(Daily Wealth, mid-2011) Every year since I can remember, real estate brokers have warned, “You’ve got to buy now… before mortgage rates go up.”Every year, the majority of economists and experts predict that “interest rates simply can’t fall any farther.” And then they do.I don’t want to make a prediction today. But I do want to point out two facts:1) For the last 30 years, the trend in interest rates has been down.2) Mortgage rates in Japan today are less than 2%.Let’s take a look at each of those facts…In the 1980s, nobody could imagine a mortgage rate below 10%. In the 1990s, nobody could imagine a mortgage rate below 7%. In the 2000s, nobody could imagine a mortgage rate below 5%. Yet here we are, in 2011… and mortgage rates have spent the last month in the 4.5% range.”

Rates today are in the 3 percent range (a drop of 33 percent from the 4.5 range when the article was written). The big take away really is that in 2012, much of the boost in prices came from this added leverage that households could take on. For example, run the numbers for the median US household income of $50,000:

$150,000 mortgage at 4.5%

Principal and Interest = $760

$150,000 mortgage at 3%

Principal and Interest = $632

$180,000 mortgage at 3%

Principal and Interest = $760

This is the big change here. All else being equal, that drop from 4.5 percent to 3 percent allowed the typical US household to purchase $30,000 more of a home without any real income growth. This is all well and good but now, unless real incomes go up, the Fed has to continue to push rates lower or face a stagnant market. Japan provides a really good example that even with mortgage rates at zero percent, longer-term unless you see real economic activity and productivity pick-up with real wage growth housing values will end up becoming stuck.

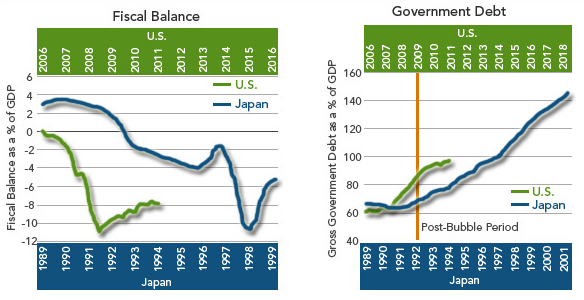

While Japan was slower to realize that they had an asset bubble and react, the US acted aggressively and subsequently, our government debt is soaring much faster than Japan:

We are already hearing rumblings from within the Fed that bond buying is likely to slow down this year:

“WASHINGTON (MarketWatch) — There was a general sense among Federal Reserve officials that their bond-buying program would last, at most, until the end of the year, according to the minutes from their meeting last month that were released on Thursday.“Several” Fed officials thought that the central bank would be able to slow or stop the purchases well before December 2013.”

Nationwide we have already seen a lost decade in home prices. In 2012 home prices did go up. Yet I see this more as a reflection of low rates and constrained supply instead of it being a healthy market. Last year, nearly 30 percent of all home sales went to investors so you have new home buyers and families competing with these groups to bid home prices higher. Japan’s real estate values are back to levels last seen 30 years ago. It should be obvious to people that with real household incomes stagnant, that most of this growth is occurring because of other forces pushing prices up in the short-term.

No comments:

Post a Comment